How Trading Halts May Impact Option Investors

A trading halt on a stock occurs when a listing exchange determines there are circumstances that necessitate a stock to be halted. A halt may be brief or for an extended period of time, but no matter the length, the impact on investors could be significant, including option holders and writers.

Trading halts are not a common occurrence. However, when considering the vastness of the financial markets, it is important to understand the process and the factors that may cause a halt.

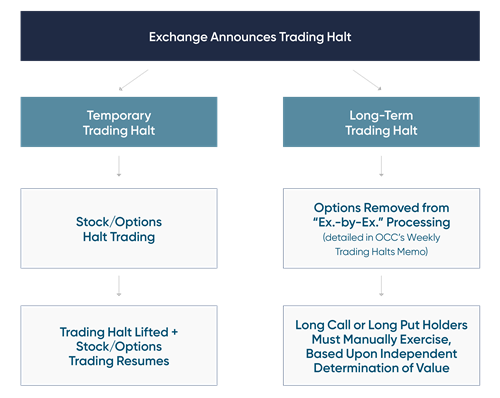

The decision is to halt a stock is typically made by the listing exchange. Brief halts may be driven by impending news, an order imbalance, a sudden movement in the underlying stock, or other factors. Longer-term halts may last for days, weeks or even longer, and are typically driven by material developments, for instance, a pending delisting or the potential bankruptcy of the underlying. Regardless of the reason, if a stock is halted, the options on the underlying stock will also be halted on the option exchanges on which it trades.

The impact of a trading halt is two-fold for any options on a halted underlying stock. First, the buyer (owner) of an option typically continues to retain control over their contract, namely the right to exercise the option, whereas the option seller (writer) remains obligated to fulfill the terms of the option, should they be assigned. However, if upon exercise and assignment of the option, the party obligated to deliver the underlying security does not already own the shares, it may be difficult to obtain the shares to deliver.

Second, long-term halts have a direct effect on the cornerstone of option prices - because there is no current, agreed upon underlying value on which to base the prices of the options. Since the Exercise by Exception (ex-by-ex) process, also known as the automatic exercise process, for options relies on the underlying stock price as its core input, without that value, OCC will typically stop automatic exercises in these cases. This, in turn, moves the onus to the option holder to make an independent determination of the value of the option deliverable in deciding to exercise, or not exercise, any expiring long positions.

If an option has been removed from ex-by-ex processing and the owner of an option determines there is value in exercising the option at or before expiration, they will need to provide exercise instructions to their brokerage firm before the firm's cut-off time for exercise instructions. Otherwise, unexercised options will expire with no value.

These events can become quite complicated. Option investors can find out more information about trading halt processing by viewing Information Memo #30049. Additional information that may help investors is also available, including on the OptionsEducation.org website, where the Options Exercise page and the Splits, Mergers, Spinoffs & Bankruptcies page could be especially useful.