Long Call Condor

This strategy profits if the underlying security is between the two short call strikes at expiration.

Description

A long call condor consists of four different call options of the same expiration. The strategy is constructed of 1 long in-the-money call, 1 short higher middle strike in-the-money call, 1 short middle out-of-money call, 1 long highest strike out-of-money call.

An alternative way to think about this strategy is an in-the-money bull call spread (debit spread) coupled with an out-of-the money bear call spread (credit spread) with the bear call spread at higher strikes than the bull call spread.

Outlook

The long call condor investor is normally looking for little or no movement in the underlying.

Summary

This strategy profits if the underlying security is between the two short call strikes at expiration.

EXAMPLE

- Long 1 XYZ 55 Call

- Short 1 XYZ 60 Call

- Short 1 XYZ 65 Call

- Long 1 XYZ 70 Call

MAXIMUM GAIN

- (Lowest, short call strike – lowest, long call strike) – Net premium paid

MAXIMUM LOSS

- Net premium paid

Motivation

Anticipating minimal price movement in the underlying during the lifetime of the options.

Variations

This strategy is a variation of the long call butterfly.

Instead of a body and two wings, the body has been split into two different (short call) strikes so that there are two shoulders in the middle and two wingtips outside the shoulders.

Maximum Loss

In all circumstances the maximum loss is limited to the net debit paid (assuming the distances between all four strikes prices are equal). The maximum loss would occur should the underlying be below the lowest long call strike at expiration or at or above the highest long call strike. At the lowest strike all the options would expire worthless, and the debit paid to initiate the position would be lost. At expiration, all the options above the highest strike would be in-the-money and the resulting profits and losses would offset.

Maximum Gain

The maximum gain would occur if the underlying security is between the two short call strikes at expiration. In that case, the lower strike long call is worth its maximum value. The profit would be the difference between the strikes less the premium paid to initiate the position.

Profit/Loss

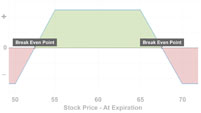

The potential profit and loss are both limited. In essence, a long call condor at expiration has a minimum value of zero and a maximum value equal to the distance between the strike prices. An investor who buys a long call condor pays a premium somewhere between the minimum and maximum value and profits if the condor's value moves toward the maximum payoff as expiration approaches.

Breakeven

There are two breakeven points. This strategy breaks even if at expiration the underlying security is above the lower long call strike plus the amount of premium paid to initiate the position or if the underlying is below the highest long call strike less the premium paid.

Downside breakeven = lowest long call strike + premium paid

Upside breakeven = highest long call strike - premium paid

Volatility

All other things being equal, an increase in implied volatility if the underlying is between the two short strikes when established would have a negative impact on this strategy. As with most strategies however, the impact of implied volatility changes will depend on strike selection relative to the stock price when the position is established.

Time Decay

All other things being equal, the passage of time will have a positive impact on this strategy.

Assignment Risk

In the case of American style options, the short options that form the body of the long call condor are subject to assignment at any time. Should early assignment occur on the short call options, the investor can exercise the appropriate long option but may be required to borrow or finance stock for one business day. The resulting position from an assignment on both short calls may still result in a net short stock position. Investors can avoid an assignment by closing out their position if the short calls appear to be candidates for an early exercise.

Be aware of situations where the underlying is involved in a restructuring or capitalization event, such as a merger, takeover, spin-off or special dividend, as that could completely upset typical expectations regarding early exercise of options on the security.

Expiration Risk

Investors face an uncertainty when the underlying trades above both short call strikes but below the highest long call strike. In this case, the investor is likely to be assigned on both short calls resulting in a short position that is unhedged following expiration. Investors in this case would be subject to an adverse move the next business day.

Comments

One important consideration of the long call condor is assignment risk. If the underlying is above both short call strikes yet below the highest long call strike, an assignment would result in both short calls delivering stock yet only one of the long calls being exercised. Thus, the investor would end up net short the underlying.

Another consideration for the long call condor is commission charges. As there are four different contracts traded, that may entail four separate commission charges to establish the position and four additional commission charges if the trade is closed prior to expiration. Investors should understand their commission costs before entering into this transaction.

Related Position

Comparable Position: Short Condor (Iron Condor)